Funds for Families: How Family Offices are Optimizing Investment Diversification

Speak with an investor relations professional or marketer at an alternative investment fund about their short to medium term plans and it will not be long until you hear the words “family office”. With the number of family offices globally and assets under management growing significantly, family offices have become an increasingly powerful investment force. As they increase in size, family offices have also increased in sophistication, becoming more institutional in their approach. As this continues, family offices will need to consider a number of factors and invest in developing a robust infrastructure to take their investment programs to the next level.

- Published

- in Analysis & Insights

Family Office Trends

Family offices represent combined investment assets of close to US$6 trillion globally. Over 50% of family offices have been created since the turn of the century and by the end of Q2 2019, there were 7,300 offices worldwide, an increase of 38% in two years. North America counts the largest concentration of family offices with 42% of the global total, followed by Europe with 31%, Asia-Pacific with 18% and the Middle East with 9%.1

Over 50% of family offices manage capital for three living generations.2 With a laser focus on preserving and growing wealth for the future generations of their family, most family offices have growing concerns particularly around diversification, equity valuations, steeper yield curves, higher long term rates and the specter of inflation. With these objectives in mind, family offices are looking to alternative asset classes to generate optimal diversified risk adjusted returns.

On average, family offices allocate approximately 35% of their portfolios to alternative asset classes and nearly half of all family offices anticipate that their allocation to alternatives will increase over the next 5-10 years. Of particular focus for family offices are private asset investments. While private equity remains the alternative investment of choice, private debt, real estate and infrastructure are all seen as capable of generating long-term yields. Currently, family offices allocate approximately 10-25% of their portfolio to private equity but 55% of family offices expect to grow their exposure to this asset class. At the same time, hedge funds appear to be enjoying a resurgence as many family offices recognize their appeal given recent market turmoil and the expectation of sustained volatility in the medium term. Moving forward, approximately 38% of family offices intend to increase their exposure to hedge funds, while all others intend to maintain their exposure at its current level3.

Given these priorities and expectations for continued institutionalization and diversification of investments, it is clear why alternative investment managers will be squarely focused on family offices. For family offices to effectively capitalize on these opportunities, however, it will be critical to have the appropriate systems, processes and infrastructure in place. This should consist of an investment structure that affords optimal access to their preferred investments and allows them to maintain their desired control, independence and discretion, supported by the necessary operational backbone and technology that can effectively manage a sophisticated investment program.

Investment Structures

High net worth individuals and family offices have traditionally managed their investment portfolios in one of two ways – through private banking relationships or through trust companies. Private banking provides a platform for the management of financial affairs with associated concierge services and private banks provide tailored banking services, preferential fees, favorable interest rates and access to certain alternative investments. However, as assets under management grows, a private bank’s management fees can be substantial. At the same time, product offerings are often limited to the bank’s proprietary products and regulatory constraints.

As such, many family offices have opted to replace or supplement private banks with trust companies or foundations that provide them with more control and flexibility to hold their family wealth. Beneath these structures are usually a complex and sometimes expensive series of special purpose vehicles which own a broad array of assets ranging from real estate, private company shares, private equity and institutional equities, to super yachts, aircraft and fine art.

However, many family offices have discovered that they can operate at lower costs with increased governance, flexibility and optionality through a new challenger to consider – fund structures. As the wealth of the family office grows, the family office often begins to behave similarly to a fund manager and, with this change, the fund vehicle becomes more attractive or indeed a real necessity. Many family offices have created their own investment offices to provide the expertise to manage their investments and to allocate to a range of assets classes. These investment offices are staffed with experienced asset allocators and investment managers who have the requisite skillset to source opportunities and invest as governed by the family’s philosophies, motivations and investment policy and may include direct investing, indirect investing, a combination of direct and indirect investments or another custom approach.

By investing directly, the investment office builds an investment portfolio around the family’s own timescale and needs, not those of other investors. These types of investments can provide greater transparency and decision-making authority, as well as increased control over other investment drivers. These factors appeal to especially entrepreneurial families or those generations that have a preference for a more hands-on approach when it comes to managing and preserving their family’s wealth. Co-investments are another popular approach that allow family offices to take advantage of the potential upside of direct investing without the responsibility of deal sourcing and due diligence. Other family offices may find that they prefer a combination of direct and indirect investments where they can benefit from certain economies of scale and possibly minimized risk. Still other family offices may prefer a more customized approach, for example pari-passu vehicles with slight alterations depending on each family member’s individual preferences.

Fund structures provide the family office with an institutionalized approach to managing and structuring its assets and an optimal means for increasing diversification and control. In addition, fund structures can improve transparency with respect to assets and valuations, further enhancing independence and discretion. Governance also becomes more central to ensuring that the investment structure provides independent oversight on asset ownership and valuation. The legal framework of a fund structure provides all parties with clarity on their rights and obligations and provides peace of mind for all family members.

A wide variety of fund structures exist in various jurisdictions that provide optimal governance frameworks and flexibility for managing a broad range of assets. Ultimately, the fund structure provides a proven mechanism for a family’s assets to be managed in a cost effective manner while providing control, independence and discretion to the family and its investment office.

Operations

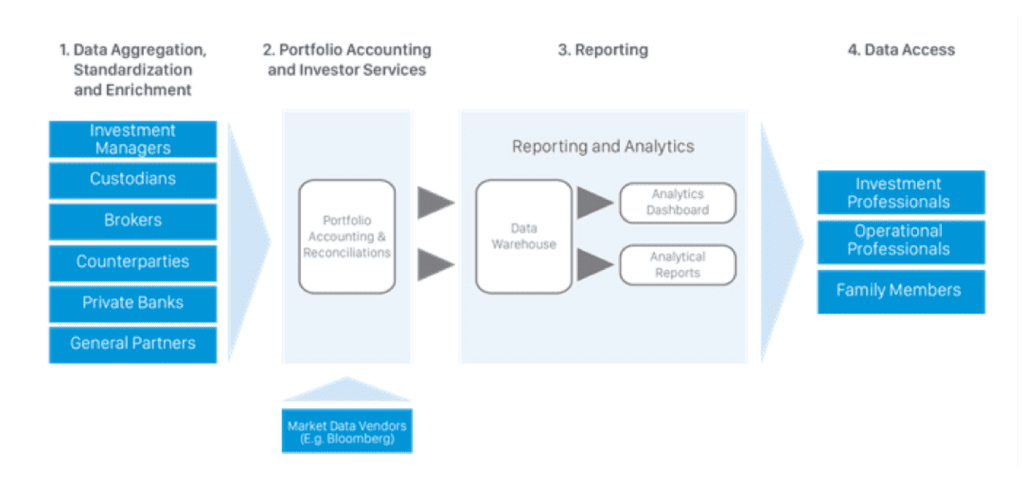

Similar to optimizing investment structures, establishing effective operations has become increasingly difficult for family offices as their investments become more sophisticated. Recognizing that every family has unique needs, family offices are seeking assistance with the operational processes required to maintain and reconcile portfolio books and records, manage cash and collateral and generate risk and performance reports on a daily basis to support the investment decision-making process. In addition, family offices leveraging fund structures require a fund administrator to calculate the net asset value of the fund(s) and perform a range of regulatory services and investor servicing. Outsourced solutions that provide the systems, processes and professional expertise to address the information requirements of today’s family offices, and the execution of sophisticated investment strategies, may include:

- Data Integration and Management: Family offices can have broad informational requirements which necessitate aggregating, processing and interpreting large amounts of data from a multitude of formats and a wide array of sources. Robust processes to manage this are critical to effective operations and can support the capture of trades in a portfolio accounting system and the capture of terms and conditions of each individual investment, among other functions.

- Output and Reporting: Operational systems should be able to aggregate data into contextualized, intuitive and accurate reports that may cover daily positions and reconciliations, as well as collateral management, liquidity and cash forecasting, and performance and risk metrics. These reports should include accompanying analytics that provide customized insight into portfolio exposures, performance and risk to support investment decision-making and beneficiary management and reporting.

- Fund Administration: Along with robust processes and systems, accounting and regulatory expertise are necessary to address the varying requirements of family offices and beneficiaries. Outsourcing functions such as NAV calculation, registrar maintenance and transfer agency, banking and fee payments, and regulatory reporting can alleviate administrative burden while creating value and enhancing effective management.

When implementing an operational infrastructure, it is important that the platform is tailored to the inherent differences between each family office. With various investment strategies and beneficiaries, all with their own preferences, motivations, and philosophies, there is often a need to invest in a range of asset classes that all pose unique operational requirements. As such, operational processes must be tailored accordingly and there is a growing need for solutions that are robust, while also being customizable, scalable, and cost effective.

Technology

Given the increased sophistication and complexity of family offices, and evolving needs of family members and beneficiaries, fulfilling the aforementioned operational requirements demands the optimization of existing processes through a robust yet scalable technology platform. This often requires a significant investment in resources and systems and many family offices may find it more efficient and cost-effective to leverage best of breed solutions and proven operational and technological expertise from third party experts.

Leading technology platforms provide the capability to seamlessly integrate with a wide variety of third parties which the family office uses to execute their investments. Once data has been aggregated and standardized, the platform must use very robust systems to ensure accurate accounting and reconciliations. To extrapolate maximum benefit from the platform, reporting solutions should be designed in concert with the unique needs of the family office. This can provide them with greater visibility into the assets in which they are invested, including position-level detail and the nuances of each instrument, their performance, and risk and custom metrics (e.g. ESG reporting). Different generations of family members typically have different manners in which they want to access their information – a platform must provide a range of options to provide these details in an intuitive and contextualized manner through the delivery mechanism most appropriate to the end user.

Ultimately such platforms enable the family office to limit their operational and technology footprint, gain access to seasoned technology professionals with a long history in the investment industry and access a proven robust and secure technology infrastructure. Family offices can then focus on utilizing these insights for sourcing investment opportunities that can support on-going wealth creation and preservation, which can be a significant source of differentiation and competitive advantage.

Given these dynamics, it is clear that many family offices may benefit from a trusted partner who understands their individual investment approach, objectives and portfolio while also providing expert support and custom solutions that meet their structural, operational and technological requirements. Recognizing that the fundamental fund administration model has evolved, the Maples Group takes a high touch approach and acts as a true extension of a family office’s day-to-day operations. Supported by a team with expertise across investment operations and technology, the Maples Group provides family offices with a bespoke offering that is scalable and designed to evolve to meet future requirements while delivering optimal solutions for the current environment. Furthermore, as part of the wider Maples Group, family offices can benefit from end-to-end support, including legal expertise in the set-up of new investment vehicles, on-going fund administration and market-leading fiduciary services to ensure the highest standards of governance are maintained.

1, 2 UBS and Campden Wealth Research. The Global Family Office Report 2019.

3 BlackRock. Global Family Office Survey. August 2020.