Investors Warm to Evolution of Commercial Real Estate CLOs

- Published

- in Analysis & Insights

Changing dynamics in the US commercial real estate sector have highlighted the use of Commercial Real Estate ( “CRE”) CLOs as a viable financing alternative to Commercial Mortgage Backed Securitisations ( “CMBS”) and with CRE CLOs evolving from their pre-crisis days, to fully managed transactions, this has added to the attraction for investors. Recently, it appears that some of the fast growth in CRE CLOs has come at the expense of traditional conduit CMBS, where, according to JP Morgan’s data, issuance stood at around US$8.59 billion at the end of April 2019, compared to US$11.25 billion for the same period in 2018. The slowdown in CMBS issuance in the early months of 2019, contrasts with the growth of CRE CLOs. The data shows that volume increased to US$5.02 billion as at April 2019 from US$3.12 billion in the same period the year before.

The Shift from CMBS to CRE CLOs

The staving off of the more traditional conduit CMBS issuances appears to be due to a number of factors according to market observers, such as:

- A more limited supply of 10-year-old loans to refinance in the post-crisis era;

- The introduction of Fannie Mae and Freddie Mac’s ‘K deals’ which are platforms securitising multi-family loans in the post-crisis era;

- New lenders entering the market, such as private debt funds and mortgage REITs (Real Estate Investment Trusts) that have taken up market share as the relatively small size of loans in conduit CMBS has allowed such borrowers to encroach on the market share conduit lenders traditionally held, whilst for single-asset/single-borrower deals that are secured on larger loans, CMBS lenders have held their ground as loan sizes are too large for most other lenders to originate; and

- Increased investor demand. As CRE CLOs tend to be short-term floating-rate issuances, secured on riskier properties than those in traditional CMBS deals, this is especially attractive to investors in a low interest rate environment as they offer investors higher yields.

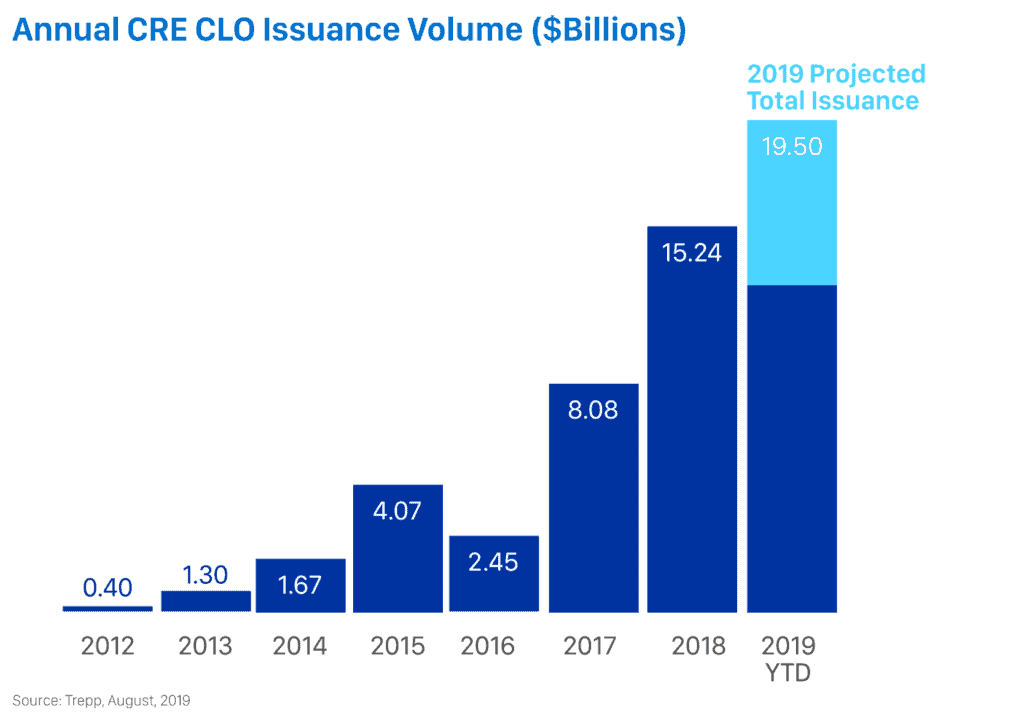

In contrast to CMBS, which dominated the commercial real estate securitisation market since the credit crisis, CRE CLOs having all but disappeared in the immediate aftermath made a more steady recovery until issuance exploded from 2017 with a doubling in volume in the space of just one year. As a number of billion-dollar CRE CLO transactions began to pepper the landscape, larger players entered the space and with 2018 issuance reaching US$15.2 billion (Trepp), the expectation is that the market could hit US$19.5 billion for 2019 if the current pace sustains through the remainder of this year. Some sceptics, however, have predicted a less favorable outlook for what they see as an overheated market ripe to burst.

Much of the growth of the CRE CLO market can be attributed to the fact that the CRE industry is very sensitive to interest rates and the volume of deals proliferated in the extremely low interest rate climate of the past decade where the US Federal Reserve cut interest rates and held them at record low levels in order to stimulate economy. This growth was further fueled by the injection of approximately US$3.5 trillion of liquidity into the US financial system from 2008 to 2014 via the US Federal Reserve’s quantitative easing programs (Thomson Reuters).

Financing strategies in the US commercial real estate sector remain in sharp focus at the current time. The longest economic expansion on record and rapid developments in the technology sector, coinciding with the co-working phenomenon, has resulted in huge demand for office space, while at the same time, concerns exist over the potential impact of a recession on the commercial real estate market, amid news reports of over 7000 US store closures in the first half of this year. Taking a step back to examine the growth of the CRE CLO product there are a number of other features that have proven popular in this environment, drawing new issuers, alongside managers already well established in other product areas to debut their CRE CLO offerings to the market.

Moving from Static to Managed Deals

Between 2012 and 2014, CRE CLOs were largely static deals, meaning that, upon prepayment of loans, those funds would be used to pay down the notes and there was no ability to reinvest in new assets. Between 2014 and 2017, there was a shift from static deals to lightly managed deals which were restricted in that principal proceeds could be reinvested, but only in existing assets. By 2017, the market was moving towards fully managed CRE CLOs which now make up a majority of issuance and enable the issuer to reinvest in completely new assets that meet the investment parameters set out in the deal documents. This transition to managed deals provides flexibility and greater opportunities to earn yield which is attractive to investors.

Asset Quality

With first lien mortgages as assets, proponents of CRE CLOs claim they offer increased security with lower leverage, which attracts investors given the yield pickup on CMBS. These deals are managed by highly motivated sponsors that for US regulatory reasons take down not only the requisite retention piece of equity, but often more.

Credit Quality

Investors and Borrowers

As the interests between highly motivated sponsors and investors have aligned around CRE CLOs, it has served to enhance the attractiveness of this asset class and bolster the market.

Observations by the Maples Group

“From a fiduciary perspective, unlike for example broadly syndicated loan CLOs, where the board is exclusively comprised of independent directors from the Maples Group, CRE CLOs generally operate on a split board basis. The split board means that one or more senior executives from the manager sit on the board as a director alongside the independent directors from Maples. Having a director from the manager on the board is not purely for practical purposes such as aiding execution of underlying asset documentation, but in particular, for managed CRE CLOs, even though day-to-day management may be delegated to the sponsor as manager, questions may still arise for the board to consider. The underlying assets are tangible real estate, often tenant occupied.” Luana Guilfoyle – Vice President, Maples Group – Cayman Islands

“The evolution of CRE CLOs from static deals into fully managed deals with additional features that enhance the offering for investors, highlights the growing need for fiduciary service providers to be well versed in more complex products and to be aware of the lessons learnt from the credit crisis. The depth and breadth of knowledge housed within the Maples Group and particularly from our active participation in transactions which span pre-crisis and post-crisis, means that our independent directors add significant value through this insight and experience.” Wendy Ebanks – Senior Vice President, Maples Group – Cayman Islands

“As we continue to see greater dealflow of CRE CLOs, market participants have come to appreciate that engaging a skilled and experienced fiduciary partner, who understands the particular nuances of this product, is paramount to a successful structure. The Maples Group provides independent managers, directors and services in the United States and across the key CLO jurisdictions globally, working synergistically to ensure an optimal experience for clients.” Jeffrey Everhart – Vice President, Maples Group – Delaware