New Regulatory Considerations for End of Year Liquidations

As firms get ready to wrap up the calendar year, it is time to take inventory of what year-end regulatory deadlines are on the horizon. For any Cayman Islands-based entities that are at or nearing the end of their life cycle, mapping out their liquidation should be part of this year-end preparation.

- Published

- in Industry Updates

One significant change this year is for entities that are registered with the Cayman Islands Monetary Authority (“CIMA”). Previous guidelines centred on 31 December as the date by which to de-register to avoid having to pay unnecessary fees. Under new guidelines handed down from CIMA, however, there is now increased clarity around the timing of the deregistration process.

What are the new deregistration rules for Cayman Islands funds?

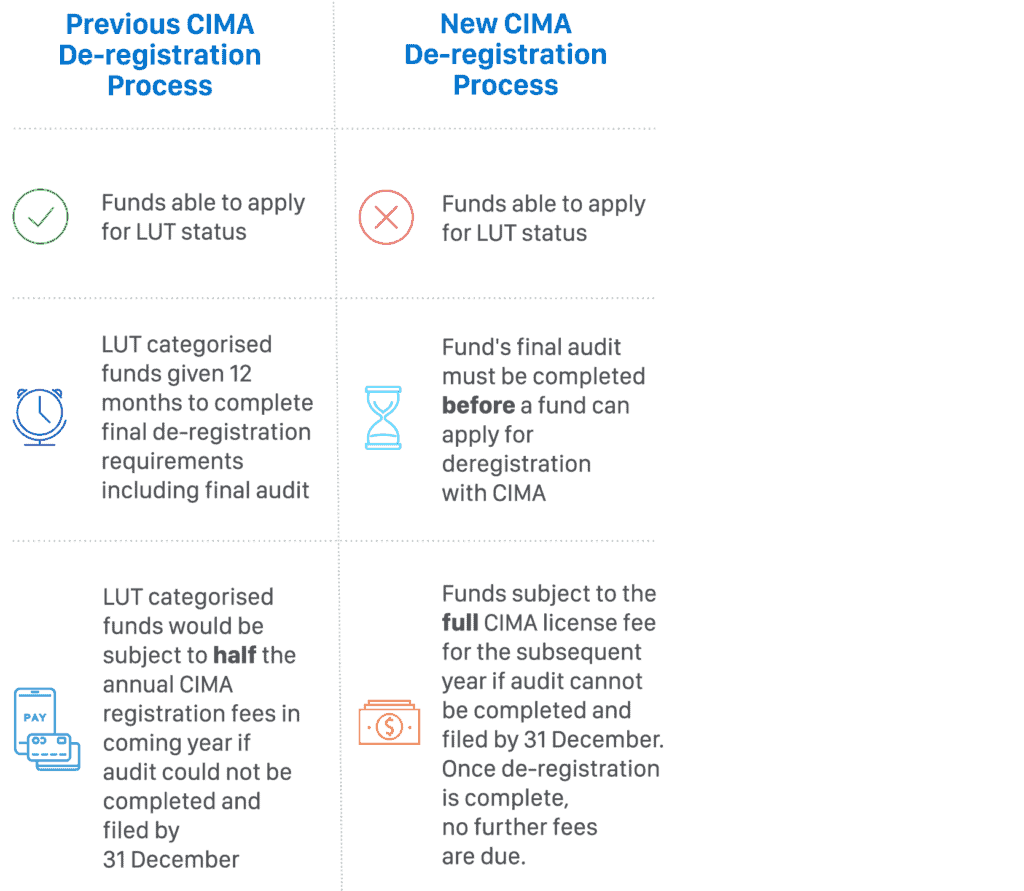

On 17 August 2022, CIMA published new deregistration rules and procedures for Cayman Islands open-ended funds that fall under the purview of the Mutual Funds Act (As Revised), as well as those registered under the Private Funds Act (As Revised). These new regulations affect both the deregistration / liquidation timeline, as well as do away with the opportunity to categorise a fund with CIMA as License Under Termination (“LUT”) status.

For funds, the key takeaway of this regulatory change is that a fund’s final audit must be completed before a fund can file deregistration documents with CIMA and therefore should accrue the full CIMA license fee for the subsequent year if the audit cannot be completed and filed by 31 December. It is important to note that the fund is still required to notify CIMA of its plans to deregister within 21 days of terminating / ceasing to carry on business. Failure to comply with this requirement can result in an administrative fine.

How does this regulatory change differ from the previous Cayman Islands liquidations process?

Under the former set of regulations, having a fund designated as LUT before 31 December meant that it would only be subject to half the annual CIMA registration fees the coming year, notwithstanding that the final audit had not been completed. After receiving LUT status, the fund in question would have 12 months to complete the audit and provide any other outstanding items to CIMA to complete the deregistration process. Now, a fund is subject to full annual registration fees until everything is filed for its formal deregistration, except in the instance of funds that had applied, and been granted, LUT or License Under Liquidation status before 17 August 2022, to which the old policy shall apply.

What are the termination audit requirements for a regulated fund?

Funds seeking to deregister from CIMA will be required to complete a final audit in most instances. Typically, in the context of a mutual fund, the final audit will cover the period up to the date of (i) the appointment of a third-party liquidator (ii) the full payment of final redemptions to investors or (iii) the final net asset value calculation, with the subsequent events note confirming that final distributions have been made to investors. Funds will need to allow for this, both in terms of the time required to prepare and submit the audited financials, as well as the associated costs.

It is important to note that the audited financial statements, and respective Fund Annual Return, are required to be filed with CIMA within six months after the balance sheet date of the financial statements. Failure to comply with filing requirements may bring about sanctions from CIMA such as an administrative fine of up to US$6,000.

Benefits of a Cayman Islands Voluntary Liquidation

The Maples Group is home to the largest voluntary liquidations team in the Cayman Islands, comprising dedicated individuals with extensive experience in the dissolution of various corporate, structured finance and investment fund vehicles. We have developed best practice procedures that meet all local statutory requirements. For a straightforward voluntary liquidation of a Cayman Islands company, we can generally complete the formal statutory process within four to five weeks, noting that the effective date of the certificate of dissolution would be three months after the final meeting.

For further information on the team and our liquidation services, please view our Overview of Services or click here to get in touch with our Cayman Liquidations team.