What Companies Need to Know About Cayman Islands Voluntary Liquidation

Companies based in the Cayman Islands considering a voluntary liquidation can benefit from beginning the process early to ensure timely filing and a smoother process as the company reaches the end of its life cycle. The procedure can be straightforward with the right preparation and guidance.

- Published

- in Industry Updates

Historically, preparing for the voluntary liquidation of a Cayman Islands company was an exercise in cost-saving measures; notably a move to avoid incurring government fees for the following year. Under these guidelines, the winding down of a company thus had to begin no later than December, with related meetings wrapped up by the end of January. This timeline allowed for an effective date of dissolution during the following calendar year as well as a way to avoid government fees for that year.

In recent years, however, depending on a company’s activities, other timelines for voluntary liquidation should be considered. Beginning the process earlier to ensure full dissolution by the end of the calendar year can help companies avoid additional regulatory costs and ease burdens associated with annual filing / reporting requirements. There are advantages to such a strategy beyond immediate cost-saving of government fees as other regulatory filings and fees in connection with a stub year can also be avoided.

What deadlines do companies need to consider for Cayman Islands voluntary liquidation?

1. Straightforward liquidations

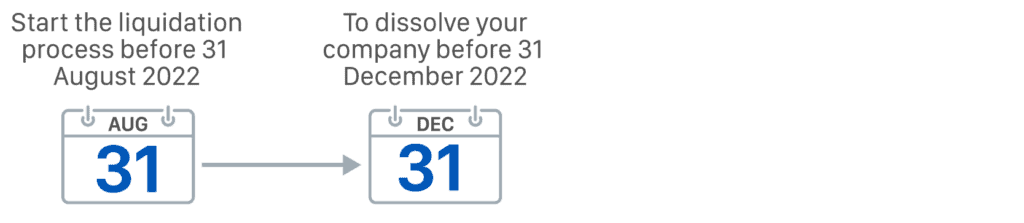

Companies looking to dissolve before 31 December 2022 need to begin the liquidation process before 31 August 2022.

2. Complex liquidations / Funds registered with CIMA

We recommend that companies with potentially more complicated cases begin the voluntary liquidation process well before 31 August.

We also recommend that funds registered with the Cayman Islands Monetary Authority (“CIMA”) under the auspices of the Mutual Funds Act (2021 Revision) or the Private Funds Act (2021 Revision) (“Funds”) commence dissolutions proceedings well in advance of the 31 August 2022 deadline to have the company dissolved by the end of the year. This is to ensure that the final audited financial statements are filed with CIMA before the Fund’s final meeting.

Any such Fund is required by CIMA to have a final audit for transactions up to the date that the third-party liquidator is appointed or to the date that final redemptions have been paid in full.

What type of company might find that a 2022 dissolution date is to its advantage?

- Companies that are Reporting Financial Institutions under FATCA or CRS

- Relevant Entities undertaking Relevant Activities for Economic Substance

Companies that fall into any of those categories may benefit from having a wind-down date effective in 2022, as they may have to file and/or report to the Cayman Department for International Tax Cooperation if in existence in 2023.

What liquidation considerations do companies need to keep in mind about the Cayman Islands Administrative Funds Regime?

- Timely filing with CIMA is paramount. A Fund must file an application to cancel its CIMA Licence or Certificate of Registration on the earlier of these two dates:

- 21 days from the date the Fund ends business; or

- 31 December of the year in which the Fund ends business as a mutual fund.

- Failure to comply may incur an administrative fine from CIMA of up to CI$5,000 (US$6,000)

- Funds looking to de-register from CIMA typically will need to undergo a final audit for the period of either:

- The date a third-party liquidator is appointed; or

- The date that final redemptions are paid in full to investors.

We recommend that Funds looking to wind down business during the second half of 2022 begin the process early to allow for these necessary filings.

To learn more about the Cayman Islands voluntary liquidations process, reach out to the Maples Group’s voluntary liquidations team. The Group has deep experience in handing the dissolution of corporates, investment funds and structured finance vehicles. Get further information and read more on our Overview of Liquidations Services. Our legal guides with information on preparing your entities for liquidation and the statutory process, Voluntary Liquidations of Solvent Cayman Islands Companies and Voluntary Dissolution and Winding Up of a Cayman Islands Exempted Limited Partnership, may also be helpful references.

Please click here to get in touch with our Cayman Liquidations team.