What Private Equity Managers Need to Know to File a Cayman Islands Fund Annual Return

The original article was published on 11 April 2022 and has been updated on 11 April 2023 to clarify that there have been no changes to the filing process since the previous year.

- Published

- in Industry Updates

30 June might seem distant, however now is the time to look ahead toward the Fund Annual Return (“FAR”) deadline for Cayman Islands Private Funds that have a financial year-end of 31 December. Following is a guide on what funds need to know about the FAR filing process and how the Maples Group can help.

What is the FAR?

Cayman Islands Private Funds registered with Cayman Islands Monetary Authority (“CIMA”) are subject to a filing requirement through their online portal REEFS, which includes informational data encompassing general, operating, related fund entity and financial information, as well as submission of annual audited financial statements and operator declaration.

This filing is an annual requirement, with funds incorporated during the first half of any given calendar year needing to report no later than six months after the end of the financial year. Declarations and waivers are required for Funds not filing, whether due to a fund not yet taking capital or reporting an extended first period (up to 18 months).

In contrast to registered mutual funds, submission is not limited to the auditor – a fiduciary service provider such as the Maples Group can submit the FAR to CIMA on behalf of private funds. This being said, the onus is on the operators of the fund, which includes any trustees, general partners or directors, to take steps to verify the report’s completeness and accuracy.

What documents are needed to file the FAR?

1. The FAR form

The biggest portion of the filing is the FAR web-based form itself (which can be extracted as an Excel spreadsheet) that asks for information about a fund’s:

- Investment advisory team;

- Any fund service providers;

- Investors, including the type of investors and their jurisdiction

- Financial statement information; and

- Related Fund Entities (Co-investment funds, AIVs, parallel funds)

There is also space to include reporting on operations, such as side letters and meetings.

2. Financial statements

In addition to including key financial data on the spreadsheet, funds must also submit a PDF of their latest audited financial statements as an attachment via the REEFS system. The form must be audited in line with either International Financial Reporting Standards (IFRS) or GAAP (generally accepted accounting principles) of certain jurisdictions which includes US GAAP, and must be signed off by a Cayman Islands registered audit firm.

3. Operator declaration

When submitting the FAR, one of the operators of the fund – trustees if a trust, directors if a company, or a General Partner if a partnership – needs to include a signed declaration along with its return about its compliance with the following sections of the Cayman Islands Private Funds Act:

- Section 16, on valuation;

- Section 17, on safekeeping of assets; and

- Section 18, on cash monitoring.

FUND ANNUAL RETURN” />

What is the process to file the FAR?

Once filled out and verified, the form is submitted via CIMA’s Regulatory Enhanced Electronic Forms Submission (“REEFS”) system, either by the auditor or by a designated service provider such as the Maples Group. The form needs to be validated for errors and those errors cleared before it will be considered filed.

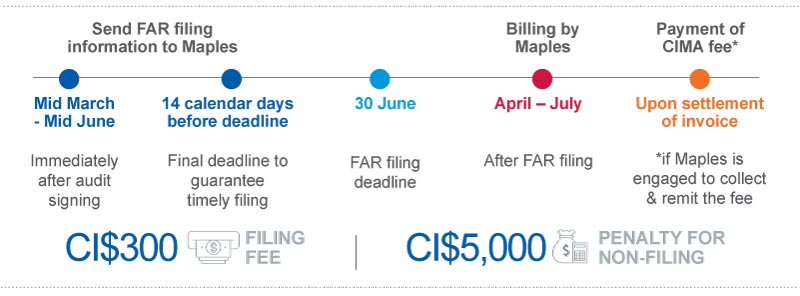

Filing fees are CI$300 (US$366), which are due at the time of filing. There is no stated penalty for late payment but the fund may not be considered in good standing until fees are paid. The Cayman Islands Administrative Fines Regime (“AFR”) issues penalties for non-filing, starting at $CI5,000 (US$6,100) per instance. CIMA has six months from becoming aware of what it considers a “minor breach” to levy a fine; actions on what the Authority considers “serious” or “very serious breaches” can be filed within a two-year window.

As many as three filing extensions per fund, each of one month in duration, may be requested if unable to meet the 30 June filing deadline, though we suggest that funds begin the FAR preparation process as soon as possible to help ensure timely completion. Non-compliance can result in penalties and in addition, there are fees associated with filing each extension. Fund managers should also keep in mind that in 2021 additional extensions were not being granted because of deadline extensions that had already been in place.

We are familiar with the FAR from last year – has anything changed in the current year?

The key change to be aware of is that the Related Fund Entities portion of the filing has now been merged into the form so rather than two separate filings, a single excel form can be extracted, populated and uploaded. As for content, there have been no changes to the regulations so the information requirements are consistent with last year. There have been some small changes to the form, however, which our team can walk you through.

How Maples Group can help you with the FAR process

Many market participants are currently operating on a model of preparing internally or through an administrator, liaising with the auditor to execute the filing and clear validation, and then relying on the registered office or internal teams for processing wire transfers to CIMA to pay filing fees. Moving to a single point of contact for the entire process significantly eases the burden the preparation, filing and payment obligations place on your team.

Our team provides on-boarding and training, provision of templates and guides, preparation and coordination of review, REEFS portal validation and submission. Our team can also collect the CIMA fee along with our service fee to allow you each fund to meet its obligations with a single payment.

The end of the first half of the year might seem far away now but deadlines often appear further away than they are. Now is the time to get started. The Maples Group is here to help with FAR filing and other fund accounting needs.

Maples can help Private Equity managers with Cayman Islands Fund Annual Return Submissions. For more information on FAR filing, get in touch with our Accounting, Tax, and Agency Services team.